Embed your ORSA process within an evo-insight business application.

ORSAs have been operational for a number of years and Solvency II remains a key metric for insurers. However, given the computation and operation complexities involved, to date the ORSA has tended to be performed once or twice a year some months after the effective date. In today’s market, management and boards want a more pro-active frequent approach to aid strategic and operational decision making in an agile and flexible manner in response to emerging internal and external market factors.

There are two key elements to the OSRA process; firstly, developing and running the underlying heavy actuarial models which generate the cashflows and results for the required scenarios and stresses. Secondly there are the reporting overlays that typically collate the cashflows, asset and other out of model data, and calculate and present in various tables and charts the projected capital, balance sheets and income statements for the various scenarios as the source for reports and presentations. These overlays tend to be performed in Excel spreadsheets which may also have embedded VBA macros to support workflow automation and the calculation processing.

Collectively, this process requires heavy model development and maintenance, large compute and storage infrastructure and suffers from standard spreadsheet end user computing (EUC) maintenance and governance issues. Consequently, the process is typically resource intensive, out of date when presented, inflexible in response to changing market conditions, is operationally inefficient and fails to the meet the growing demands for interactive forecasting and “what-if” analyses.

Zenith’s evo-insight uniquely addresses these issues:

1. evo-insight has a rich and mature “no code” library of asset and liability cashflow models which are fully maintained by Zenith. These models can be easily configured, with no model changes, to reflect emerging product structures, assumptions and ORSA scenarios. And as it runs on the evo-insight platform it can produce results rapidly due to the virtually unlimited processing power of Azure.

2. evo-insight can embed existing spreadsheets and VBA macros within a web application to provide the required governance and control, user friendly dashboards, “what if” interactions and storage, and production of pdf reports. The spreadsheets may either leverage the evo-insight “no code” derived cashflows or those from existing cashflow engines.

As an alternative to embedding existing ORSA spreadsheets, Zenith consultants have extensive experience in developing rich interactive “what if” ORSA reporting tools and spreadsheets to support the desired strategic and operation and decision making.

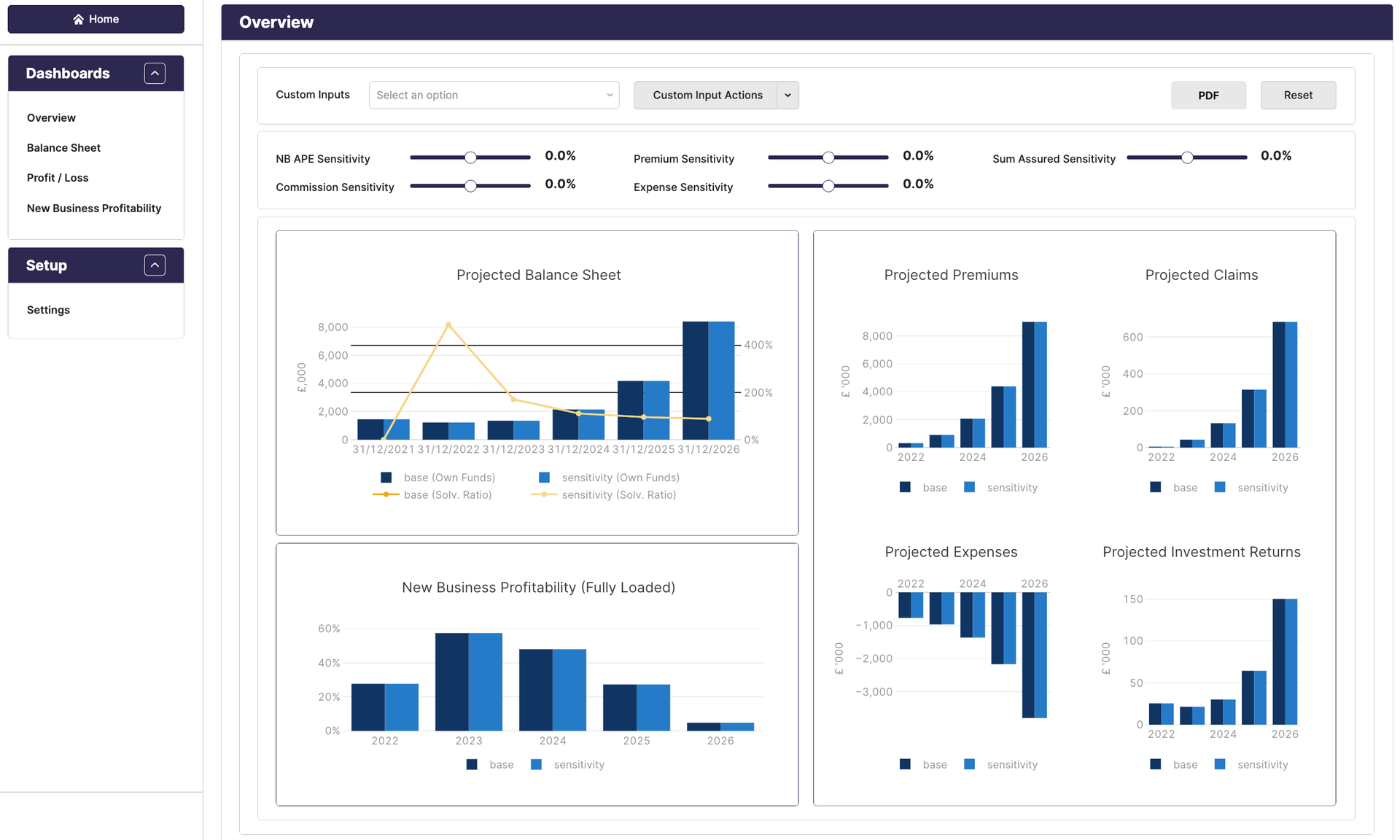

An example of an interactive dashboard is illustrated below

Collectively, evo-insight supports getting the ORSA into the hands of the CFO, Boards, and other decision makers rapidly via configurable models, workflow automation, scalable compute and storage, interactive hosted web applications and pdf report generation all within a governed environment.

For more information, please contact us at enquiries@zenithactuarial.com

The post Driving value from your ORSA appeared first on Zenith Actuarial.

Insights