Insights

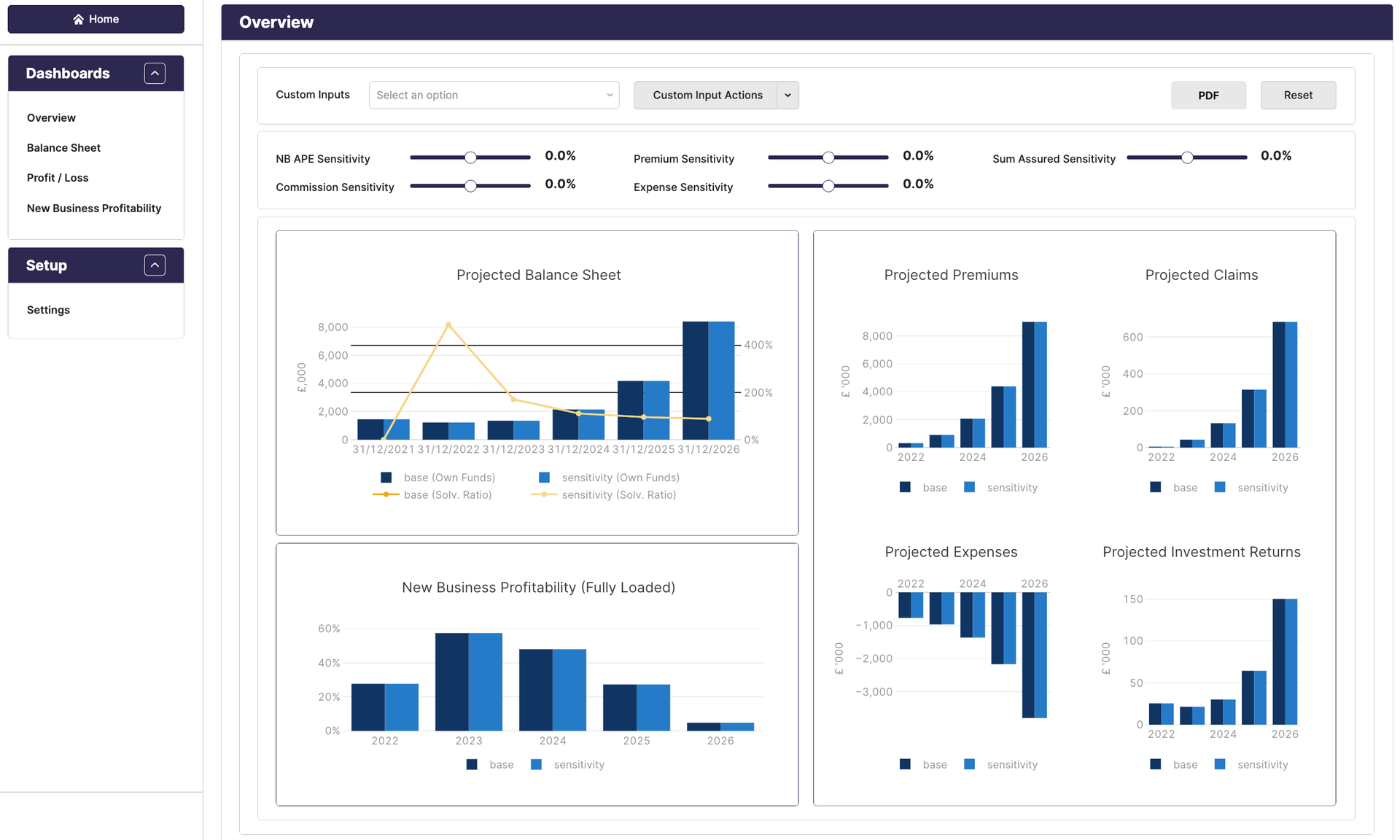

We are delighted that our evo-insight no-code modelling solution has won the prestigious InsuranceERM’s Annual UK & Europe Awards 2024 Solvency II Solution of the Year. The judges felt that “evo-insight stood out as a…Read more

The post Solvency II Solution of the Year appeared first on Zenith Actuarial.

Spreadsheets are a critical component in actuarial, finance, pricing, and underwriting processes. However, these complex spreadsheets, often with embedded VBA macros, typically present numerous challenges related to governance, performance, automation,…Read more

The post Are you looking to rapidly to convert your complex spreadsheets into powerful web applications? appeared first on Zenith Actuarial.

Are you struggling to provide accurate, timely information for business planning? Finance departments are continuously seeking to support the business planning and decision-making process in a governed, rapid, and responsive manner. Much of the information…Read more

The post Are you struggling to provide accurate, timely information for business planning? appeared first on Zenith Actuarial.

Accelerating Product Development & Pricing with evo-insight Insurers seeking to develop new products or reprice existing ones typically have to build models in either their legacy actuarial modelling solution, spreadsheets, or…Read more

The post Accelerating Product Development & Pricing with evo-insight appeared first on Zenith Actuarial.

We are pleased to announce the launch of our Market Insights AI service powered by evo-insight. Leveraging PRA monthly Solvency II data, this service provides users with an interactive AI driven experience coupled with…Read more

The post Zenith’s new Solvency II Market Insights AI Service appeared first on Zenith Actuarial.

The Bulk Purchase Annuity (BPA) market in the UK has been growing rapidly and is set to expand further with new entrants joining the existing participants. At Zenith we have…Read more

The post No Code Applications for Bulk Purchase Annuities appeared first on Zenith Actuarial.

PRA Solvency II reforms: CP19/23 Reform of the Matching Adjustment From our work supporting many UK insurers, we appreciate that the Solvency UK reforms will be a key focus for…Read more

The post Reform of the Matching Adjustment appeared first on Zenith Actuarial.

The financial services sector frequently utilises complex, stochastic spreadsheet models, which can contain months or years of valuable development work and IP. Often, these spreadsheets need to access externally generated scenario files or use Excel’s random distribution generators…Read more

The post Auto-Scaling of Stochastic Spreadsheet Models with evo-insight appeared first on Zenith Actuarial.

We are delighted that the Insurance ERM 23/24 Enterprise Risk Management Technology Guide features an interview with our Commercial Director Dan Wainwright in which he discusses how evo-insight supports insurers…Read more

The post Discussing technology trends in the InsuranceERM technology guide appeared first on Zenith Actuarial.

The insurance market is a dynamic and increasingly complex environment. This has led to growing demands on actuarial and finance departments to produce new and enhanced analytics, to support strategic…Read more

The post Delivering Governed Analytics Rapidly into the Hands of Users appeared first on Zenith Actuarial.

Many insurers have now reported their 2023 HY results for the first time. This is clearly a major milestone. However, from our discussion with clients this is being viewed as…Read more

The post 2023 – The Next Phase of the IFRS 17 Journey! appeared first on Zenith Actuarial.

Using evo-insight to Produce PRIIPs Key Information Documents. Background Manufacturers of Packaged Retail and Insurance-Based Investment Products (PRIIPs) are required to provide investors with a Key Information Document (KID) for…Read more

The post evo-insight simplifies and automates your PRIIPs process appeared first on Zenith Actuarial.

Embedding Spreadsheets and VBA macros within a powerful evo-insight business web application evo-insight is Zeniths’ new modelling and analytical platform designed to rapidly deliver governed analytics directly to internal and…Read more

The post Supercharge your Spreadsheets with evo-insight appeared first on Zenith Actuarial.

Christos and Jenny joined the Zenith Team last year as Graduate Analysts, after competing degrees at the The University of Manchester and Newcastle University. We can’t believe a whole year…Read more

The post Our Graduate Students: One Year On appeared first on Zenith Actuarial.

Her Majesty’s Treasury (HMT) has published consultation on Solvency II review, detailing the UK government’s package of proposed reforms to the prudential regulatory regime for insurance firms. The Prudential Regulation…Read more

The post HM Treasury publishes consultation on Solvency II review appeared first on Zenith Actuarial.

How did you become an actuary? At my school in High Wycombe during sixth form, a life insurance company called Equity & Law invited some of us for an open…Read more

The post Meet the Team: Tim Bateman, Senior Actuary appeared first on Zenith Actuarial.

With the 1st January 2023 effective date for IFRS17 fast approaching, we understand how hectic IFRS17 teams will be as they work towards finalising their implementation programmes. Whilst companies have…Read more

The post IFRS17 – helping you reach the finish line appeared first on Zenith Actuarial.

What’s the reaction generally from people when you tell them you are an Actuary? They’re often still confused! I usually describe an Actuary as similar to an accountant, which isn’t…Read more

The post Meet the Team: Gemma Stonehouse, Senior Actuary appeared first on Zenith Actuarial.

Martin joined Scott Robinson at Zenith 4 years ago to bring his actuarial technological insights and skills to the company. He is passionate about changing the way actuaries access and consume…Read more

The post Meet the Team: Martin Sher, Chief Operating Officer appeared first on Zenith Actuarial.

Caroline Evans is the Zenith Office Manager and all round Queen of Organisation. We would be lost without her! Can you tell us a little bit about your working life…Read more

The post Meet the Team: Caroline Evans, Office Manager appeared first on Zenith Actuarial.

Like to know more?

Please get in touch to discuss further how we can support your business.